Ethereum, a cryptocurrency that has generated much speculation and controversy, has been the subject of much debate. While some argue that it is merely a bubble waiting to burst, others claim that it represents one of the most significant investment opportunities of the century. While opinions on Ethereum vary widely, there is no doubt that there is a great deal of interest in this digital asset.

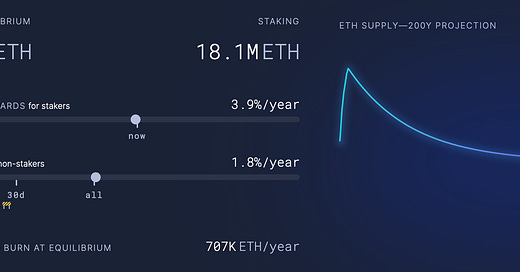

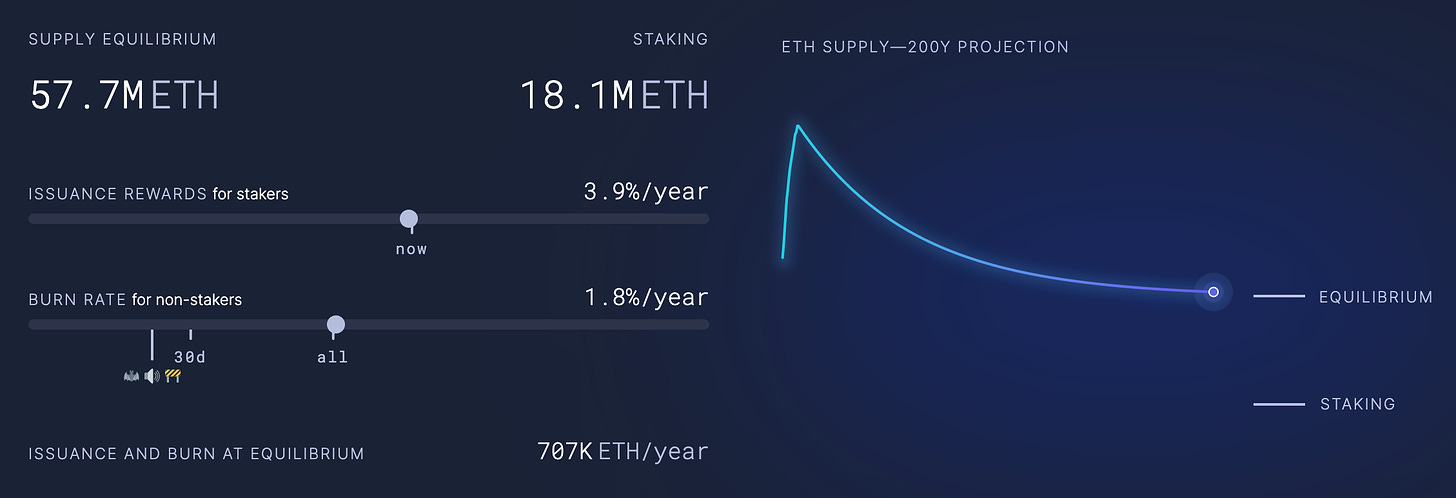

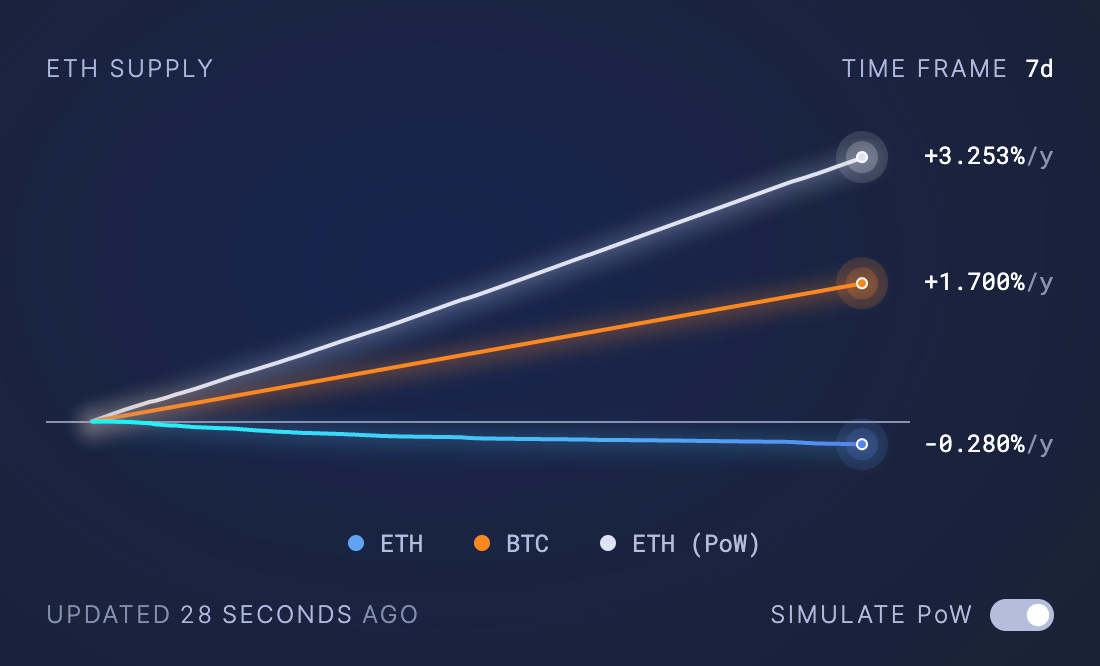

One of the reasons that Ethereum is so interesting to investors is its deflationary monetary policy.

While Bitcoin is known for its limited supply of 21 million coins, Ethereum takes this concept even further. With the Merge the inflation rate of Ethereum was reduced by 90%. This means that the supply of Ethereum is not only be limited like Bitcoin, but will decrease over time as coins used in transactions are burned and disappear.

In addition to its monetary characteristics, Ethereum is a large ledger that supports smart contracts, enables decentralized finance, and created the NFT boom. This makes Ethereum a valuable asset for those looking to store their time, as well as a valuable tool for those looking to create and invest in new digital assets.

Despite its potential, the price of Ethereum has risen and fallen like a yo-yo, scaring off many potential investors. However, volatility is necessary for explosive growth, and those who have done their research can take advantage of these drops to buy Ethereum at bargain prices. In fact, owning Ethereum can generate passive income, with investors earning interest on their holdings.

Furthermore, Ethereum is one of the most popular platforms for building new decentralized applications and has been used to create some of the most exciting innovations in the crypto space. The Ethereum platform has been instrumental in the rise of non-fungible tokens (NFTs), which have revolutionized the way digital art and other digital objects can be owned and transferred. It has also enabled the rise of decentralized finance (DeFi), which allows people to lend and borrow money without the need for an intermediary.