The cryptocurrency guru reveals his fail-safe strategy for earning profits of 1000% in a volatile market

Maximize your earnings with expert cryptocurrency advice

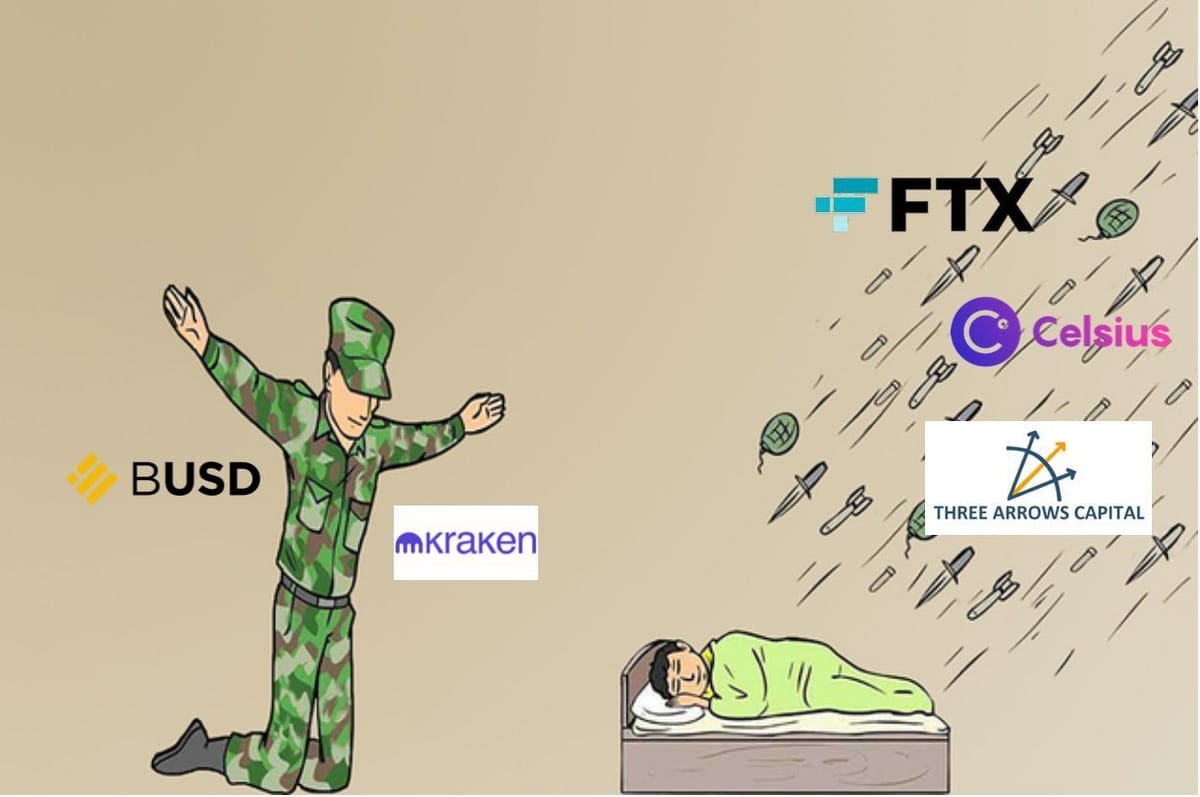

The SEC is stepping up and has taken two major steps in 3 days:

Banning the issuance of $BUSD through PAXOS.

Banning cryptocurrency staking through the Kraken exchange in the US. In other words, the SEC is banning good crypto products, but not the bad ones that have already collapsed.

The SEC did not protect us (only US residents) from:

FTX

Celsius

3AC

Luna/UST

Voyager

And many others...

Kraken receives a $30M fine from the SEC.

Here, Gary explains why.

Jesse Powell, CEO of Kraken, responds to the video posted by Gary.

Banning the issuance of $BUSD through PAXOS

The SEC deemed the stablecoin $BUSD a "security" and threatened to sue the company responsible for its issuance, PAXOS, which has stopped doing so.

However, according to the Howey test, stablecoins should not be considered a "security," as shown in item 3. There is no expected benefit in exchange for the purchase of these coins.

But...

Each coin could be considered a share/stock of a fund.

You might say, "I buy $1 in $BUSD and expect to receive $1, not $1 + interest. There is no expected gain."

But this makes it even worse and more valuable to be regulated; the coin's customers bear all the risk and receive no profit from the issuing company.

So now I wonder, if this has happened with $BUSD, why couldn't it happen with other stablecoins? The answer is that it could.

Therefore, we need to assess how this news has affected and will affect $BUSD to make a decision in our portfolio.

How it has affected:

Fear -> Sell

Drop in $BUSD price

How it will affect:

Go to court

Fine to the entities behind the Binance and Paxos coins.

Therefore, in the worst case, those who cannot bear the fine will go bankrupt => Fall/Rise of the stablecoin => and Loss of money if we had that coin in our portfolio.

But if you have that fear, don't worry; a very profitable strategy can cover all of this and even earn more than 1100%, which I am using myself.